Consider Before Purchasing a Foreclosed Home.At first glance, a foreclosed home might appear to be the perfect opportunity to snag a fantastic deal on a house. However, prospective buyers should exercise caution, as these homes often conceal a multitude of hidden costs that can swiftly turn a supposed bargain into a financial quagmire. If you find yourself considering a foreclosed property, it’s crucial to be well-prepared and informed. Check out our top tips for the essential steps to take when you’re in the market for a foreclosed home, ensuring that you make a smart and informed decision. Buyer beware!

Ensure Informed Decision-Making: Prioritize a Home Inspection

Before taking the plunge into a real estate purchase, it’s essential to acquaint yourself with the property’s true condition.

For a relatively modest fee, a qualified home inspector can offer a comprehensive evaluation of the home’s structural integrity, mechanical systems, and other significant components.

This inspection not only provides valuable insights into the property’s current state but also helps you make an informed decision.

Armed with a clearer picture of the house’s condition, you can plan for necessary repairs or, in the event that the property presents more challenges than benefits, opt to step away from the deal. Prioritize a home inspection to ensure your investment aligns with your expectations and budget.

Uncover the Home\’s Hidden History: The Importance of Thorough Inspection

When considering the purchase of a home, understanding its history is essential.

Typically, when selling a house, a Seller’s Property Disclosure Statement (SPDS) is provided, offering valuable insights into the home’s maintenance, repairs, and any additions made over the years.

However, in cases where a bank owns a property due to foreclosure, this critical document is absent.

The absence of this historical context makes a comprehensive home inspection all the more vital. In such situations, it may be the sole means to uncover the changes and modifications made to the property throughout its lifetime.

Don’t underestimate the importance of a thorough inspection – it’s your key to discovering the hidden history of the home and making an informed investment decision.

Prepare for a Smooth Transition: De-Winterize Your New Home

When acquiring a property that has sat vacant for an extended period, it’s crucial to inquire about the status of the utilities.

In many regions, it’s a common practice to drain the pipes to prevent freezing during winter months. However, before conducting a home inspection, it’s essential to pressure-check and activate all systems.

These de-winterization procedures may vary depending on local regulations and guidelines.

To ensure a smooth transition and a comprehensive inspection, it’s advisable to consult your real estate agent, who can provide you with valuable referrals and insights tailored to your specific municipality’s requirements. By taking these precautions, you’ll be well-prepared to assess your new home thoroughly and make informed decisions about its condition and functionality.

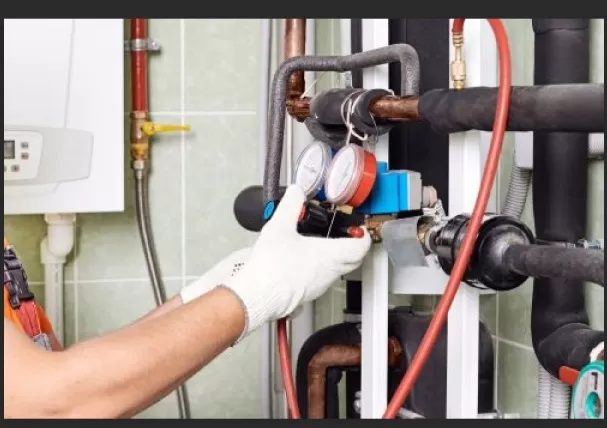

Foreclosed Homes: Spotting Plumbing Problems Before Committing

Foreclosed homes can hide serious issues, and plumbing problems are among the most common and costly.

What might initially appear as minor bathroom repairs could escalate into significant damage, potentially costing thousands to rectify. Before committing to a purchase, it’s essential to assess the plumbing situation.

Here are some key steps to help you spot plumbing problems:.

Water Pressure Check: Test faucets throughout the house to ensure adequate water pressure.

Low pressure could indicate plumbing issues.

Inspect Ceilings and Baseboards: Examine ceilings and baseboards for water stains or discoloration, which can be signs of leaks from above or below.

Mold and mildew: Keep an eye out for mold or mildew in damp or poorly ventilated areas.

These can be indicators of ongoing moisture and plumbing problems.

By being vigilant and conducting a thorough assessment, you can gain a clearer understanding of the property’s plumbing condition and make informed decisions regarding any necessary repairs or renovations.

Assessing HVAC Systems in Abandoned Homes: A Vital Step

In abandoned homes, neglected HVAC (Heating, Ventilation, and Air Conditioning) systems can lead to several issues.

Dust and debris accumulating in ductwork can pose health hazards, while boilers and furnaces may deteriorate in humid conditions. Before you can test the functionality of these appliances, it’s likely that you’ll need to address cleaning and repair tasks.

Here’s what you should consider when investigating HVAC systems in abandoned properties:.

Ductwork Inspection: Examine the ductwork for dust, debris, and potential mold growth.

Cleaning and sanitizing may be necessary to ensure proper indoor Air Quality.

Boiler and Furnace Assessment: Check the condition of the heating system.

Look for signs of corrosion, leaks, or damaged components that may require repair or replacement.

Appliance Functionality: Test the operation of boilers, furnaces, and air conditioning units to ensure they work efficiently and safely.

Humidity Control: Address any humidity-related issues, such as mold growth or moisture damage, that could impact the HVAC system’s performance.

A thorough evaluation of the HVAC system is essential to ensure the comfort, safety, and energy efficiency of the property.

Addressing these issues early on can save you both time and money in the long run.

*The information is for reference only.