Money-Saving Apps and Tools for Your Finances. In today’s fast-paced world, managing your finances can be overwhelming. Fortunately, there are numerous tools and apps available to help you make the most of your income and achieve your financial goals..

Remember that the key to financial success is consistency and discipline. Utilize these tools and apps to stay organized, make informed financial decisions, and take control of your financial future. With these resources at your disposal, you’ll be well on your way to saving, investing, and budgeting like a pro!

Unleashing the Hidden Potential of Your Pocket: The Path to Financial Freedom

In today’s fast-paced world, managing personal finances can be a daunting task for many, leading to a staggering number of individuals trapped in debt.

The alarming revelation that 137 million Americans were already grappling with financial burdens was unveiled in a 2019 study. And with the onset of the COVID-19 pandemic, the job market took a severe hit, pushing even more people into financial hardship.

In the face of such challenges, responsible spending and saving become paramount, but they can be incredibly arduous tasks.

The accumulating interest rates can feel like an insurmountable obstacle, making it seem impossible to escape the vicious cycle of debt. However, there is a silver lining to this financial conundrum.

Thanks to technological advancements, there are now a plethora of helpful apps and tools readily available on your smartphone, tablet, or computer that can provide a lifeline to financial stability.

These innovative applications offer a multifaceted approach to conquering your financial woes.

Not only do they assist you in creating and adhering to a well-structured budget, but they also introduce ingenious strategies to save money while spending. Moreover, some of these ingenious tools even facilitate investing spare change, turning seemingly insignificant amounts into a flourishing financial future.

With the power of these financial companions at your disposal, it’s time to dive headfirst into the world of smart saving and investing.

Embrace the convenience, security, and potential these technological marvels offer, and embark on a journey to grow your wealth starting today! So, delve into the realm of financial prowess, seize control of your fiscal destiny, and watch your savings grow, one cha-ching at a time.

Mint: Empowering Your Financial Journey

Mint, a highly popular and free budgeting app, acts as your personal financial companion, effortlessly syncing with your bank accounts, credit cards, and investment portfolios.

By aggregating all your financial data in one user-friendly interface, Mint offers you the convenience of a high-level overview of your financial health.

One of Mint’s most impressive features is its automatic budget creation, which is tailored to your individual spending habits.

It categorizes your expenses efficiently, allowing you to label them as you see fit, while also providing suggested spending limits for each category. This automated budgeting process proves to be a boon for those who struggle to save consistently, as it takes care of what you might find excuses to postpone.

Beyond budgeting, Mint goes the extra mile by offering additional valuable insights.

You can access your credit score and even monitor the current value of your home, empowering you with a comprehensive understanding of your financial standing at all times.

With Mint at your side, managing your finances becomes a seamless experience.

Gone are the days of tedious spreadsheets and juggling multiple accounts; Mint streamlines everything, putting you firmly in control of your financial destiny. So, embrace the power of Mint, and embark on a journey towards financial success and stability.

Your financial goals are now within reach—start using Mint today!.

Goodbudget: Empowering Financial Success through Envelope Budgeting

At the heart of Goodbudget lies a powerful concept: the envelope budget.

This innovative approach empowers you to take control of your finances by categorizing your expenses into distinct envelopes, each with a predetermined spending limit. By adhering to these limits, you cultivate the habit of spending within your means, leading to greater financial success.

Once you’ve allocated funds to each envelope, that amount becomes the total available for spending within that specific category.

A noteworthy aspect of Goodbudget’s methodology is its emphasis on accountability and discipline. If you happen to exceed the budgeted amount in one envelope, the app encourages you to refrain from increasing your overall budget.

Instead, you learn to make informed choices and, for instance, borrow from another envelope to cover the excess expenses. This valuable lesson in financial responsibility helps you accept and adapt to unforeseen circumstances, such as utilizing funds earmarked for a vacation to address an unexpected car repair.

Goodbudget’s versatility extends beyond individual use, making it an ideal financial tool for households as well.

Families can collectively manage their finances, with each member contributing to shared envelopes, fostering a sense of financial teamwork. Whether it’s saving for a family vacation or any other collaborative expenditure, Goodbudget facilitates seamless coordination.

The app provides a generous offer of 10 envelopes for free, allowing you to experience the benefits of envelope budgeting without any upfront costs.

For those seeking further financial diversification and enhanced capabilities, a nominal $6 monthly fee unlocks the full potential of the app.

With Goodbudget as your financial ally, you can bid farewell to financial stress and embrace a more organized and responsible approach to managing your money.

So, take charge of your financial future, embrace envelope budgeting, and experience the freedom that comes with being in control of your financial destiny. Begin your journey to financial empowerment with Goodbudget today!.

MoneyWiz: Your Ultimate Financial Hub for Real-Time Budgeting

MoneyWiz emerges as a comprehensive budgeting app, offering the perfect solution to streamline all your financial data into a single, accessible location.

One of its standout features is the live syncing capability, enabling real-time data synchronization across multiple devices. This means you can witness instant updates on your computer after making payments, transfers, or expenses on your phone, eliminating the need for tedious waiting periods.

With MoneyWiz’s powerful budgeting tools, you can effectively manage both one-time and recurring financial goals.

Whether you’re saving for a significant purchase like a car or keeping track of regular bills like utilities, the app helps you allocate funds accordingly, ensuring that you stay on top of your financial commitments. By effectively setting money aside for specific purposes, you gain greater control over your finances and avoid any unnecessary stress.

While the free version of MoneyWiz requires manual syncing of accounts, a small investment of $4.

99 per month or $49. 99 annually unlocks the convenience of automatic account syncing.

This instant viewing feature saves you time and effort, making your financial management journey even more seamless.

MoneyWiz goes above and beyond by providing access to a wealth of financial reports, graphs, and custom analyses.

This comprehensive view of your financial stability empowers you with valuable insights, helping you make informed decisions and better understand your financial standing.

Incorporating MoneyWiz into your financial routine grants you the freedom to focus on your financial goals with confidence.

Bid farewell to scattered financial information and embrace the efficiency of real-time data syncing. Experience the ease of managing your finances in one centralized location and gain a clearer perspective of your financial situation.

Don’t wait any longer; take charge of your financial future with MoneyWiz today!.

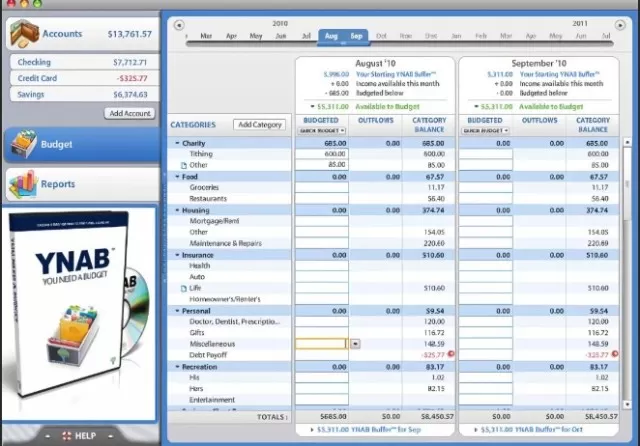

YNAB (You Need a Budget): Empowering Financial Mastery with Four Rules

YNAB, short for You Need a Budget, presents itself as a transformative app designed to revolutionize the way you manage your finances.

With the option to automatically sync your accounts or manually input financial data, YNAB caters to both tech-savvy individuals and those who prefer a more cautious approach to sharing their financial information.

The app operates on four fundamental rules, each geared towards fostering better financial habits and securing your financial future:.

Give every dollar a job:At its core, YNAB encourages you to assign a specific purpose to every dollar you earn as soon as it enters your account. By doing so, you proactively allocate funds to various categories, such as bills, savings, or discretionary spending, before spending them.

This approach ensures that your money is well-managed and not impulsively frittered away.

Embrace your true expenses: YNAB advocates for setting money aside for non-monthly expenses, allowing you to Be Prepared for irregular or infrequent financial obligations. Whether it’s property taxes or holiday gifts, creating a dedicated fund for such expenses ensures that they don’t catch you off guard and derail your budget.

Roll with the punches:Emergency savings play a crucial role in YNAB’s philosophy. This rule prompts you to be flexible and adaptable by moving money from less essential categories to cover unexpected or urgent expenses.

For example, if a car repair arises, you can tap into funds allocated for a vacation without compromising your overall financial stability.

Age your money: YNAB encourages you to break the cycle of living paycheck to paycheck. Instead of spending your entire monthly income, strive to set aside some funds to cover next month’s bills.

This practice helps you gradually build a financial buffer and achieve a state of financial freedom.

While YNAB comes with a price tag of $11.

99 per month or $83. 99 annually (at $6.

99 per month billed annually), its potential benefits are substantial. The app claims to save users up to $600 in the first two months alone, making the investment in financial stability and long-term savings well worth it.

Incorporate YNAB into your financial routine, and witness the transformative power of disciplined budgeting and strategic financial planning.

Take control of your finances, build resilience against unexpected expenses, and embark on a journey to a more secure financial future. With YNAB as your ally, you’ll be equipped to navigate the twists and turns of life with confidence.

Start your budgeting revolution today with the first month free!.

*The information is for reference only.