Smart Steps to Prepare for Buying a House Next Year. Absolutely! Being prepared is key to ensuring a smoother and more successful home search and purchase process.

Whether you’re a first-time homebuyer or have experience in the real estate market, being well-prepared can make a significant difference. By being well-prepared, you can navigate the home search and purchase process with greater ease and confidence. This preparation not only saves time and effort but also helps ensure that you find a home that truly meets your needs and aligns with your long-term goals.

Navigating the Path to Homeownership: Taking it One Step at a Time

Purchasing a home marks a thrilling milestone in life, yet the journey involves numerous individuals and intricate processes.

From mortgage applications and real estate agents to coordinating movers and more, it can be overwhelming to tackle everything simultaneously. However, with careful planning and preparation, you can significantly reduce the stress associated with this significant investment.

Take the time to conduct thorough research, establish a realistic budget, connect with a suitable lender, and enlist the expertise of a reliable real estate professional. By following these steps diligently, you’ll find yourself closer to unlocking the door to your new, beloved home sweet home.

Remember, every step counts, and with determination and foresight, your dream of homeownership will soon become a reality.

Examining Your Credit: A Crucial Step in the Mortgage Journey

Before embarking on the mortgage application process, one of the foremost actions a lender will take is to scrutinize your credit history.

Therefore, it’s essential to be proactive and review your credit reports in advance to ensure their accuracy. Request comprehensive credit reports from all three major bureaus, namely Equifax, Experian, and TransUnion, at least a year before you intend to apply for a mortgage. This strategic approach provides you with ample time to carefully assess the reports and rectify any discrepancies, if present. Moreover, it grants you the opportunity to enhance your credit score if necessary, making you a more desirable candidate in the eyes of potential lenders. Taking the time to examine and optimize your credit standing will place you on a stronger footing as you embark on the path to securing your dream home.

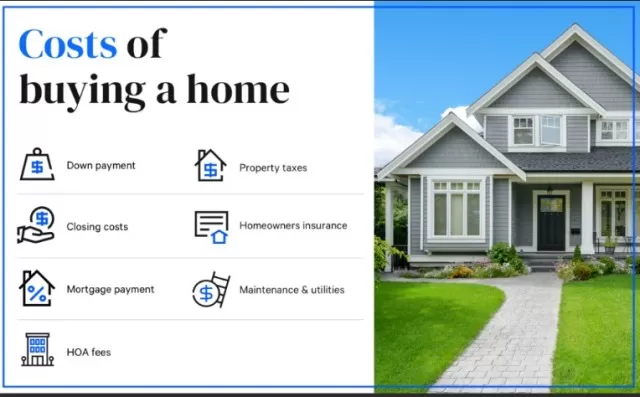

Crafting Your Financial Plan: Preparing Your Budget for Homeownership

Embarking on the search for your dream home requires a solid understanding of your financial capabilities.

To begin, it’s crucial to calculate your debt-to-income ratio (DTI), a fundamental metric that lenders use to assess borrowers’ financial health. However, don’t stop there—take the time to conduct thorough research on the local taxes, utility costs, and other expenses you can anticipate as a homeowner.

These additional monthly costs vary significantly depending on the location of your prospective purchase, so it’s essential to factor them into your personal budget. By diligently integrating these expenses into your financial planning, you’ll be better equipped to determine what you can comfortably afford, paving the way for a successful and sustainable homeownership journey.

Remember, a well-crafted budget is the key to unlocking the door to your New Home with confidence and peace of mind.

Empower Your Homebuying Journey: The Advantages of Getting Preapproved

Securing a preapproval for a loan is a savvy move that can significantly streamline your entire home shopping and purchasing experience.

By obtaining preapproval, you gain a crystal-clear understanding of your financial capacity, allowing you to focus your search on neighborhoods that align with your budget. This not only saves time but also ensures you explore properties that you can realistically afford, avoiding any unnecessary disappointments.

Moreover, the benefits extend beyond just guiding your search.

When you possess a preapproval letter, it signals to sellers that you are a serious and credible buyer. In competitive real estate markets, this can make all the difference.

Sellers are more inclined to prioritize offers from preapproved buyers, as they bring an added level of certainty to the transaction. In hot markets where bidding wars are common, having that preapproval in hand gives you a distinct advantage over other buyers, increasing your chances of securing your dream home.

By taking the proactive step of obtaining preapproval, you set yourself up for success in the homebuying process.

It provides you with confidence, leverage, and a competitive edge, ultimately paving the way towards finding the perfect home that aligns with both your desires and financial means.

Discovering Your Ideal Community: The Art of Exploring Neighborhoods

Finding the perfect neighborhood for your future home is a crucial aspect of the homebuying journey.

To make an informed decision, invest time and effort in conducting comprehensive research on prospective areas. Take a proactive approach by visiting these neighborhoods at various times of the day and on different days of the week.

This will provide valuable insights into the neighborhood’s dynamics and ambiance, helping you gauge whether it aligns with your lifestyle and preferences.

Engage with the locals if you have the opportunity.

Speaking with neighbors can offer valuable firsthand perspectives on the community, giving you a sense of the warmth and camaraderie among residents. If you have a family, observe if there are children playing outside, as this signifies a vibrant and family-friendly environment.

By immersing yourself in this thorough research, you’ll be able to eliminate neighborhoods that do not meet your requirements—whether they are too bustling, excessively quiet, or simply not the right fit for your family.

Armed with this knowledge, you’ll be prepared to act swiftly when an enticing property becomes available in your ideal community. Making the effort to explore and understand neighborhoods lays the foundation for a gratifying homeownership experience in a place you’ll be proud to call home.

*The information is for reference only.